Agile: Swing Trade Optimizer

Agile: Swing Trade Optimizer is a dynamic trading system specifically crafted for swing traders. It focuses on optimizing trade setups over short to medium-term horizons. By analyzing market trends and price action, Agile identifies high-probability swing opportunities, balancing risk and reward effectively. This system is ideal for traders looking for a balanced approach to capturing market swings, combining strategic planning with responsive execution.

This indicator tracks overbought and oversold conditions to get you in and out, on the right side of the market, while minimizing the risk to your capital.

Benefits Of The System

Optimized for Swing Trading: Agile is specifically designed for swing trading, ensuring that its tools and analytics are tailored to the unique needs of capturing profits from market swings over short to medium-term periods.

High-Probability Trade Identification: The system employs advanced market trend analysis and price action to pinpoint high-probability trading opportunities, increasing the chances of successful trades.

Effective Risk-Reward Balancing: Agile focuses on balancing risk and reward, which is crucial in swing trading. This approach helps traders manage their exposure while aiming for substantial returns.

Adaptability to Market Changes: The system is dynamic and adjusts to changing market conditions, enabling traders to stay aligned with current trends and price movements for optimal trading decisions.

Strategic Trade Planning: Agile combines strategic planning with its analytics, helping traders in formulating well-thought-out trading plans that consider various market scenarios.

Responsive Execution: The system is designed for responsive execution, allowing traders to quickly capitalize on identified opportunities without significant delays, which is essential in swing trading where timing is critical.

Suitable for Various Market Conditions: Agile’s robust analysis tools make it effective in a range of market conditions, whether in bullish, bearish, or range-bound markets, providing versatility to swing traders.

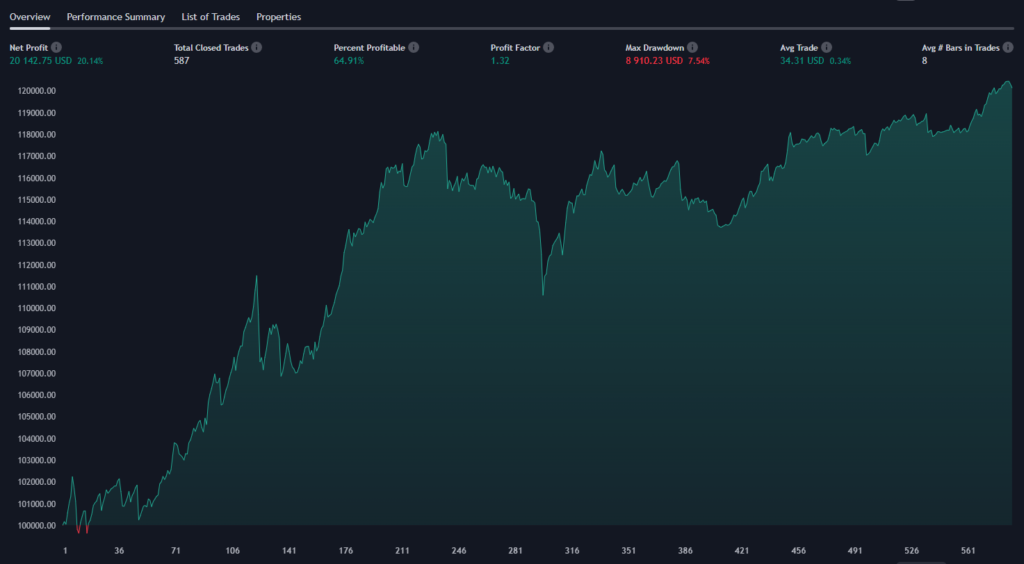

Equity curve for Bitcoin (BTC)

This is what the equity curve looked like for BTC, a nice 72% win rate. $1,000 invested would have returned $20,000. You are in and out of trades on average, in 8 periods. Most importantly, you would have avoided the huge drawdowns in 2018 and 2022.64

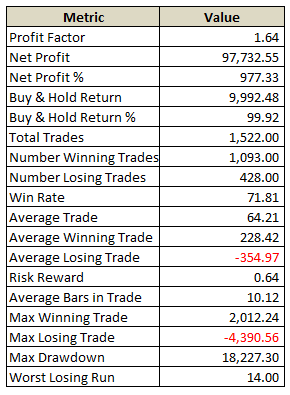

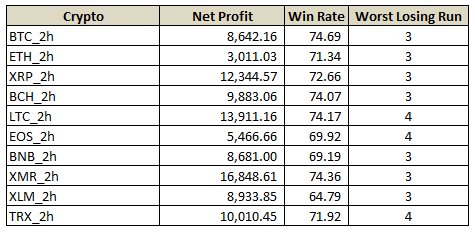

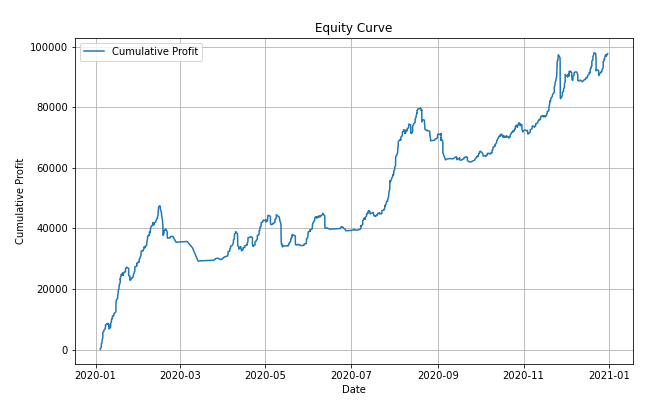

Performance Top 10 Cryptos - 2020

We backtested in Python and got a similar result for the top 10 cryptos in 2020 only. 10K invested would have returned nearly $100,000.

How To Use The Indicator

Create an Account on TradingView. Visit tradingview.com and click “Start free trial.”

Select a ProfitWithTrading Subscription Plan. Next, choose a suitable ProfitWithTrading subscription.

Order Your ProfitWithTrading Indicator. Fill in the order form, including your TradingView Username for indicator access..

Get Access and Start Trading. You will receive an email with details about your trial or subscription. Check the “Invite-only scripts” tab on TradingView.

Add the indicators to Your Chart: Select ‘Invite-only scripts’: Choose the desired ProfitWithTrading indicator(s) and click on the name to add them to your account and chart.

Set up alerts to receive alerts on your phone.

How To Customize The Indicator Settings

Unlike other algo providers, we make our indicators as easy to set up and use as possible. You can use this system out of the box without making any changes. If you do decide to make some changes, there are only a few settings to customize, which we will describe below.

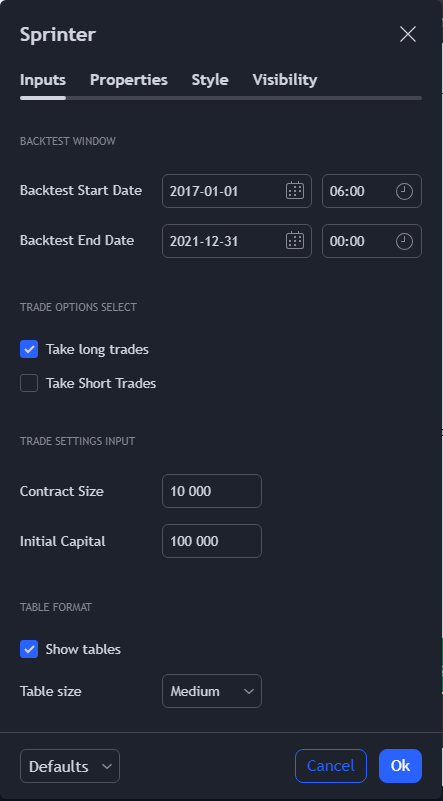

BACKTEST WINDOW

The system tracks and shows historical PL and trades. How far back goes will be limited to your Trading View account. You can set it to show historical backtest results or start from when you start using the system.

TRADE OPTIONS

You can configure the algo to take long trades, short trades, or both. We recommend taking only long trades in bull markets and short trades in bear markets.

TRADE SETTINGS INPUT

Set up your initial capital and contract size.

TABLE SETTINGS

You can show or not show the system performance table. You can also select the size of the table. The options are Mobile (extra large), Large, Medium, and small.

Recommended Instruments

Sprinter works well in trending and ranging markets. It has been thoroughly tested in the crypto markets. It also works well with tech stocks like Nvidia, Meta, Microsoft, etc.

Sprinter has not been tested on the Forex markets. If you decide to use on Forex, check the backtest results.